- Free budgeting software that links to your bank account how to#

- Free budgeting software that links to your bank account trial#

YNAB comes with a free trial for your first 34 days. Learn to save and spend less than you earn.Īs per its website, the YNAB budgeting tool helps new budgeters save $600 in their first two months and more than $6,000 in their first year. You can adjust your budget easily as you learn more about your spending habits. The app helps you save towards large and less frequent expenses, so you won’t have to break the bank when disaster strikes. This is similar to the cash envelope system (without the paper envelope) in which you assign every dollar a task in your various spending categories and then execute your plan through the month. The app functions around four major rules and is one of the best budget apps for iPhones: YNAB is a premium finance app that takes budgeting to a totally different level. If you are looking for a premium budgeting app that covers the basics and more, the ones below are worth checking out! 4. For now, all their services are free.Ĭlick to get the Wally app. They plan to offer an optional premium service in the future (such as currency conversion) which may cost $0.49 to $4.99. The app makes it easy to track your expenses, scan receipts, create budgets, and set goals. It is free and has received top ratings in many countries. Wally is a basic personal finance app that is available on iPhones and Android. The average KOHO user is said to reduce their spending by 15% and save almost $500 in the first 3 weeks of using the app!Ĭlick to get KOHO (includes $20 sign-up bonus!) 3. It does much more than that and can almost replace your bank. The KOHO app is not your typical budgeting app. Access a portion of your paycheque a few days early.Joint accounts and is a great budget app for couples.Directly pay your bills and receive payments e.g.

Free budgeting software that links to your bank account how to#

You can set savings goals (both personal and joint) and the app shows you how to reach them.1.20% interest rate earned on your entire balance.

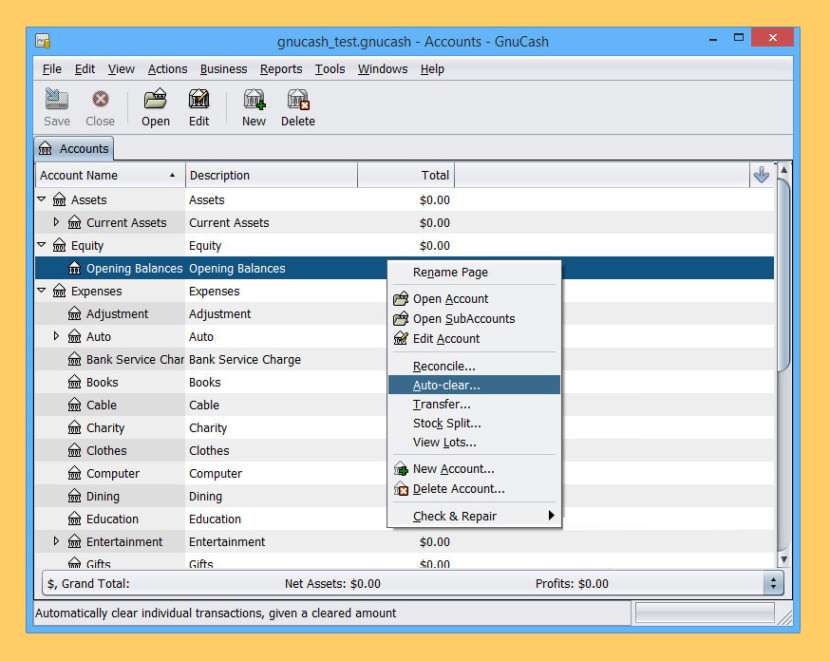

0.50% to 2% cash back on all your purchases.Roundup feature that automatically saves your spare change.Effortless budgeting with real-time insights into your spending (daily, weekly, and monthly) and savings.The KOHO app and card offer the following benefits: It is free and available on iPhone and Android. KOHO is a reloadable Visa card and app that functions as a prepaid spending card, money-saving app, and is a budgeting tool. Worried about the security of your account? Mint uses the same 128-bit SSL encryption that banks use. It supports all the major banks in Canada. The Mint app makes budget creation a breeze and will send you alerts about unusual charges and upcoming bills. The app gives you a platform to view all your financial accounts in one place so you can automatically track your spending and set saving goals. Mint is the most popular free budgeting app with more than 20 million users. You can even create parallel budgets, one for the year and one for the current month, to have both a long- and short-term view.ĭirect Connect lets you connect your accounts directly to your bank accounts, so new transactions stream in automatically and are automatically reconciled with your pending transactions.These free budgeting apps meet your basic budget needs and are available on the Apple Store and Google Play. GreenBooks lets you create a budget that accounts for all of your spending and income categories, so you know how much you are saving at the end of a budget period. The Trends chart gives you the answer you are looking for. For example, see if your overall account balance is going up or down, compare your overall incomes to expenses, or compare your groceries to dining expenses.

Quickly gauge your financial performance over time. You can easily toggle between different periods, and drill into a category to see more detailed breakdowns. In GreenBooks, you can see a breakdown of your expenses and incomes by categories. With one click, see where your money is going. It's simply the most pleasant user interface for keeping track of your accounts. We made everyday tasks like entering transactions super fast, so doing it everyday is not a chore. As a financial tracker, GreenBooks lets you easily keep track of all your accounts without hassle or distraction.

0 kommentar(er)

0 kommentar(er)